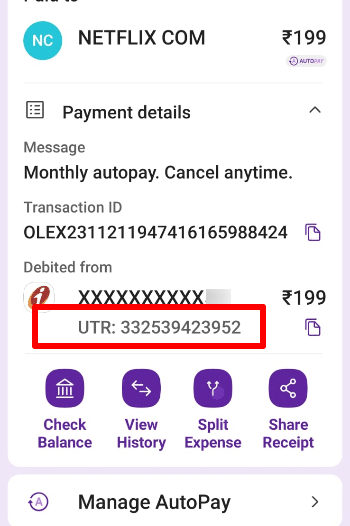

Bank transfer stuck? No worries! UTR to the rescue! This unique code tracks your transfer like a superhero, letting you see if it’s lost or just late. Find it in your bank app or statement, and use it to check or fix any issues. UTR – your money’s best friend!

Bank Rules

How to Create and Reset SBI YONO MPIN

To access your SBI YONO app, you need your MPIN. However, if you forget it, you can easily reset it. If you are a new user of YONO, You can also set New MPIN by following the given process. In this post, I’ll walk you through the steps to change or reset your UPI PIN […]

What is UTR Number? How to Find UTR and Check Status

The full form of the UTR number is the Unique Transaction Reference number. When you send money between banks, each transaction gets a unique UTR number.

Account Payee Cheque: How to Issue and Encash?

In today’s digital age, most individuals possess a bank account equipped with chequebook facilities. However, the use of physical cheques has dwindled resulting in a general lack of familiarity with crucial terms such as “Bearer cheque,” “Crossed cheque,” and “Account Payee cheque.” This article aims to bridge this knowledge gap by exploring these terms in-depth […]

How To Activate Airtel Payment Bank’s Dormant Account

If you haven’t used your Airtel Payment Bank account for several months, it may become dormant. This means you won’t be able to withdraw or deposit money, or use your account balance for recharges and payments. This post will guide you on how to reactivate your dormant Airtel Payment Bank account. Why Your account become […]